Because this blog entry of mine comes up third in Google for the term Wealthstreet, I feel a certain responsibility to share some information with people who are searching for what happened to their investments.

For those that haven’t heard, Wealthstreet seems to be no more. Their phone numbers are disconnected, and while their Web site still loads, it hasn’t been updated in some time. The last time I spoke with anyone from Wealthstreet was back in May of this year (and it was a hushed conversation involving whispering), and I suspect that once the hosting bills go unpaid for a few more months, the Web site will go off-line. The good news here is that Wealthstreet was “only” a broker – so if you invested in AGCAPITA, First West Properties (formerly Averio), or the MOSAIC Fund, your investments aren’t impacted by Wealthstreet imploding. If only the same could be said for our Concrete Equities investments.

I was concerned about the Dragon Fund however – this was a fund created by Dave Jones, and while we didn’t have much money in it, I had pretty much given up hope of getting it back. This article had a few interesting comments that related to that fund. I’ll reproduce them here in case the source article gets deleted:

“I managed to talk to someone last week and it looks like Dave has laid off all of his staff and has closed his doors. In regards to investments I was told that if you have invested in anything other then the dragon fund your money is o.k. as Wealthstreet was only selling shares, not a partner in the investments. The dragon fund however is a different matter as this was Dave’s fund. Currently it is up in the air as to what will happen to this fund and the money that investors put into it. If Dave can sell it investors may get their money back or at least most of it, but if that fund goes down with the Wealthstreet then all the invested money could be lost.”

And this one:

“The above posting pretty much on point. Concrete is what is is…not good…not good at all. Investments such a Mosiac & AgCapital are still whole and seem to be run by quality fund managers. Wealthstreet was simply a ‘broker’ for these funds. Dragon Fund was simply marketed through WealthStreet who acted as a broker for this fund as well. It is entirely seperate from WealthStreet itself and is managed as a seperate entity by Dave Jones. The sole asset in Dragon Fund (bareland in Airdrie) is currently up for sale. If the land is sold the funds from the sale of the asset should be returned to investors.

The trustees on the fund are actively managing the situation and have significant control even though Dave Jones is the fund Adminstrator. The trustees are not in a postion to gain anything financially are definitely looking out for the best interest of the investors. Now if you are a ‘promissory’ note holder that is another investment I would be very concerned about! Good Luck!”

The problem of course is that I don’t know how to get in touch with these trustees of the Dragon Fund…a Google search has come up empty. Does anyone have any contact information for anyone related to the Dragon Fund?

I should also note that I was phoned by someone from the Alberta Securities Commission a couple of months ago – he wanted to know about the promissory note we did with Wealthstreet. He asked me a lot of questions, and I faxed him the original contract for investment. In short, we loaned Wealthstreet $50K, and got back $55K, earning 10% on our money after one year. They offered us the opportunity to leave our money invested and earn another 10% over the following year, but we declined – and it’s a good thing we did, because I imagine anyone who left their money in is finding it impossible to get back now.

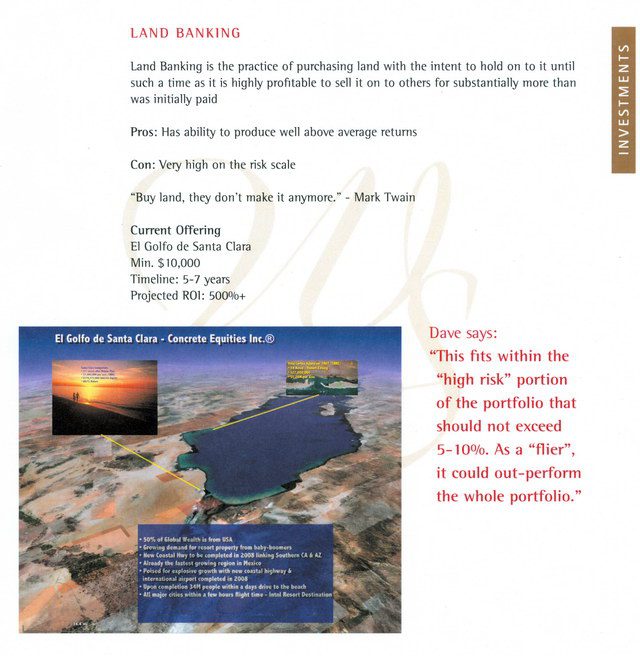

Lastly, I was cleaning up some paperwork related to Wealthstreet and found one of their original brochures and thought for laughs I’d scan the promotional pieces they used to tell investors about the Calgary real estate investments with Concrete Equities, and the Mexico land-buy with Concrete Equities.

A five year annual projected ROI of 18.79%? Hah! I wish…I think anyone invested with Concrete Equities would happily settle for getting their original investment back and zero percent growth. Safe? Dependable? If only it had worked out that way…