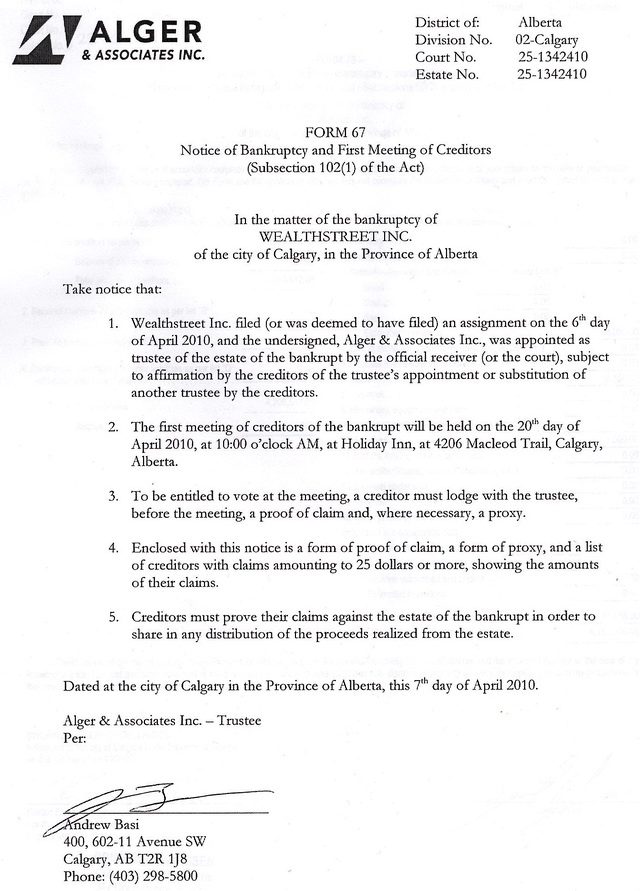

If you’re in the Calgary area and have had any dealings with Wealthstreet or Dave Jones, the President and CEO of Wealthstreet, the above notice of bankruptcy of Wealthstreet Inc. tells you where the company is at now. I get a few emails a month asking me what’s happening with Wealthstreet, and now it’s official. I’m not an accountant, but according to page two of this document, there are $3.2 million in unsecured creditors, $942K in preferred creditors, for total liabilities of $4.2 million dollars. The asset side of the equation shows $40K in accounts receivable, $4.4K in cash, and $1K in furniture. Somehow this company that dealt with millions of dollars in investment money only has assets totaling $45K. Interesting how that worked out, isn’t it?

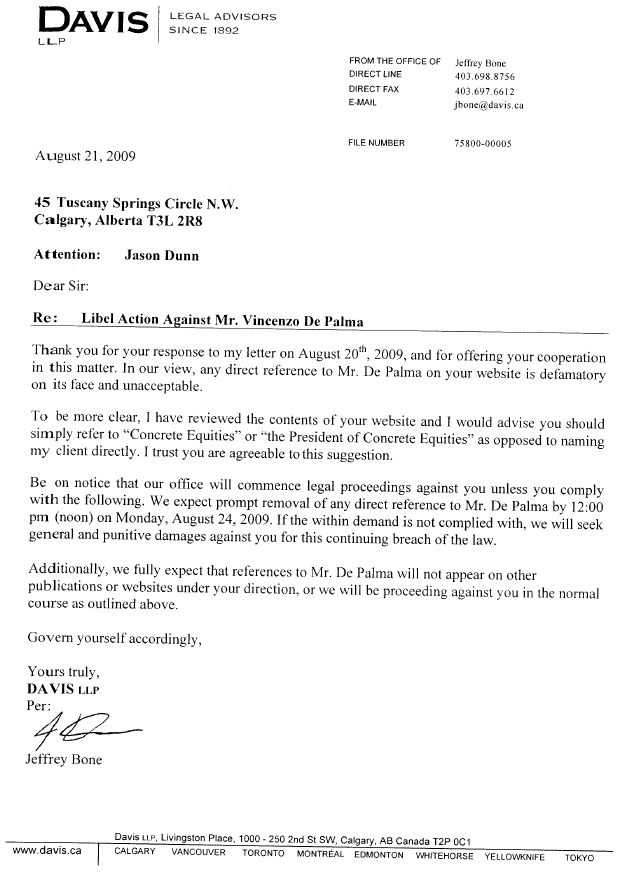

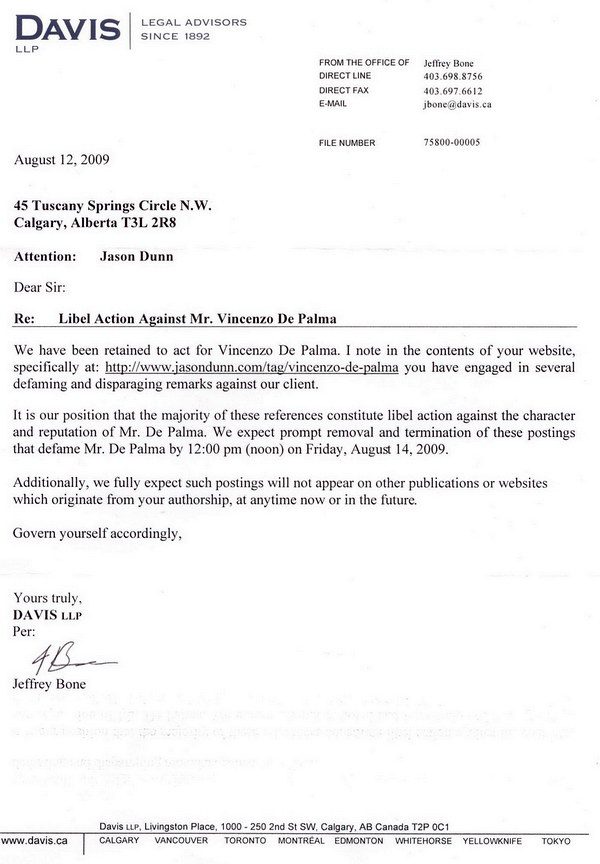

The sad part of this document is the list of unsecured creditors; there are 136 individuals and companies on that list – most of them individuals – who are owed large sums of money. $50,000…$100,000…one couple is owed $228,167! Entire life savings were wiped out, which I find disheartening. I feel very fortunate that we were able to escape losing virtually nothing directly with Wealthstreet, instead having the bulk of our money locked up in the battle with the now-defunct Concrete Equities – a battle that seems to be nearly won last I heard. I received a copy of this document because apparently we have an unsecured claim with Wealthstreet of $1…despite what the cover letter says about a minimum $25 claim. I certainly never filed any claim with Wealthstreet.

Worth noting is that the single largest unsecured creditor is by Rachel Poffenroth in the amount of $658,874. Why is that worth noting? She was the one-time President of Wealthstreet – she held the position when Ashley and I started dealing with Wealthstreet. Also noteworthy is that the second biggest creditor, this time a preferred creditor, is one Dave Jones, claiming $650,000. Given the corporate assets of $45K, I think they’re both out of luck. It’s a strange world we live in…