Canadian 1 cent (penny) coin heads

[Download high-res version, transparent PNG]

Canadian 1 cent (penny) coin tails

[Download high-res version, transparent PNG]

Canadian 1 cent (penny) coin heads

[Download high-res version, transparent PNG]

Canadian 1 cent (penny) coin tails

[Download high-res version, transparent PNG]

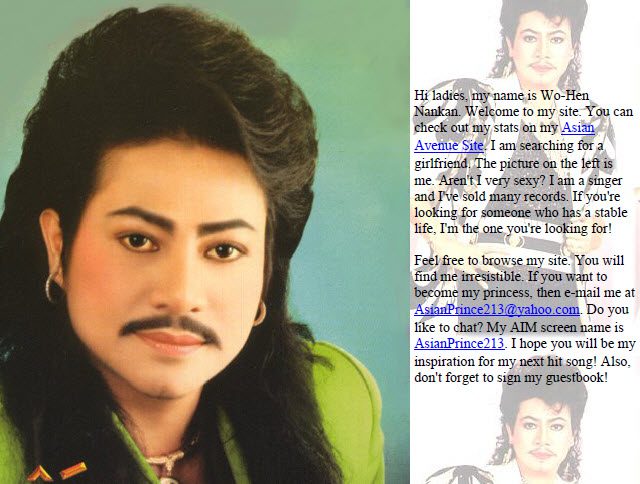

Geocities is no more, but as I was scanning and archiving a really great Wired article (scanning a bunch of images to a PDF file is slick!), I came across a PDF file I made back in 2001, eight whole years ago…it was pulled together from a site, hosted on Geocities, that was one of the most hilarious prank/hoax sites I’ve ever seen. It’s so well done that when I first saw it I thought it was all real. It looks like I’m not the only one wanting to make sure this great site doesn’t fade from memory, but I figure I’ll post this entry anyway just for fun… 😉

I’d never heard of this movie until today, but after watching the trailer above, I have to admit I got a little quite misty-eyed by the end…I’m a sucker for football movies, and true stories where someone’s life is changed for the better, so when you combine the two it just gets me. The actor who plays “Big Mike” is 6 foot 10 inches!

UPDATE: Apologies for the fact that the video starts playing automatically…I removed it because of that. Check out the trailer over on the site.

Look what I found on the Alberta Securities Commission Web site:

“Calgary-based Teluric International Investments Ltd., the Teluric Diversified Fund, David Humeniuk and Elizabeth Humeniuk have provided an Undertaking to the Executive Director of the Alberta Securities Commission (ASC). The Undertaking comes after ASC staff identified that the parties failed to disclose in a Teluric Diversified Fund offering memorandum information required by Alberta securities laws. No sales occurred pursuant to the offering memorandum, nor are any sales contemplated in the future. The Undertaking states that Teluric International Investments, the Teluric Diversified Fund, David and Elizabeth Humeniuk agree they will cease all trading and refrain from any further trading of Teluric Diversified Fund securities until such time as the Executive Director releases them from this Undertaking.”

Who’s Dave Humeniuk you might be wondering? Why, he was a Director at Concrete Equities of course! Some truly interesting things have been said about the Santa Clara Mexico investment in court documents involving Dave Humeniuk and Vincenzo De Palma (sort of a “he said, he said” thing), and I’m planning on publishing those in the next week or two. Court documents aren’t libel because they fall under Absolute Privilege. Any lawyer reading this knows that. The document relating to the above ASC action can be found here – in short, it says that Dave Humeniuk needed to “Disclose any penalty or sanction (including the reason for it and whether it is currently in effect) that has been in effect during the last 10 years against (i) a director, executive officer or control person of the issuer, or (ii) an issuer of which a person referred to in (i) above was a director, executive officer or control person at the time.”

It seems he didn’t do that, and that’s against the rules.

Because this blog entry of mine comes up third in Google for the term Wealthstreet, I feel a certain responsibility to share some information with people who are searching for what happened to their investments.

For those that haven’t heard, Wealthstreet seems to be no more. Their phone numbers are disconnected, and while their Web site still loads, it hasn’t been updated in some time. The last time I spoke with anyone from Wealthstreet was back in May of this year (and it was a hushed conversation involving whispering), and I suspect that once the hosting bills go unpaid for a few more months, the Web site will go off-line. The good news here is that Wealthstreet was “only” a broker – so if you invested in AGCAPITA, First West Properties (formerly Averio), or the MOSAIC Fund, your investments aren’t impacted by Wealthstreet imploding. If only the same could be said for our Concrete Equities investments.

I was concerned about the Dragon Fund however – this was a fund created by Dave Jones, and while we didn’t have much money in it, I had pretty much given up hope of getting it back. This article had a few interesting comments that related to that fund. I’ll reproduce them here in case the source article gets deleted:

“I managed to talk to someone last week and it looks like Dave has laid off all of his staff and has closed his doors. In regards to investments I was told that if you have invested in anything other then the dragon fund your money is o.k. as Wealthstreet was only selling shares, not a partner in the investments. The dragon fund however is a different matter as this was Dave’s fund. Currently it is up in the air as to what will happen to this fund and the money that investors put into it. If Dave can sell it investors may get their money back or at least most of it, but if that fund goes down with the Wealthstreet then all the invested money could be lost.”

And this one:

“The above posting pretty much on point. Concrete is what is is…not good…not good at all. Investments such a Mosiac & AgCapital are still whole and seem to be run by quality fund managers. Wealthstreet was simply a ‘broker’ for these funds. Dragon Fund was simply marketed through WealthStreet who acted as a broker for this fund as well. It is entirely seperate from WealthStreet itself and is managed as a seperate entity by Dave Jones. The sole asset in Dragon Fund (bareland in Airdrie) is currently up for sale. If the land is sold the funds from the sale of the asset should be returned to investors.

The trustees on the fund are actively managing the situation and have significant control even though Dave Jones is the fund Adminstrator. The trustees are not in a postion to gain anything financially are definitely looking out for the best interest of the investors. Now if you are a ‘promissory’ note holder that is another investment I would be very concerned about! Good Luck!”

The problem of course is that I don’t know how to get in touch with these trustees of the Dragon Fund…a Google search has come up empty. Does anyone have any contact information for anyone related to the Dragon Fund? Continue reading What Happened to Wealthstreet and Dave Jones?

Wow..this is just so incredibly geeky and cool. As an old-time D&D player, this strikes a chord with me. If only we had technology like this back in the day…actually, it might not have been quite as much fun now that I think about it. 😉

I was awarded the MVP recognition this year again for my work in the Windows Mobile world – 12th year running – and the award is really cool. It’s really cool not because it’s a shiny thing I can put on my shelf to make myself feel important (I buy big monitors for that ;-)), but because they’ve implemented a “token” system whereby each year re-awarded MVPs will get a new year slice they can put on top of the previous one. This prevents the tremendous waste of sending out the same award year after year with a new date stamped on it. I think it’s great that the people working on the MVP program came up with such a smart way to reduce waste.