Photos from October through December 2010. Logan’s growing up so fast!

Photos from October through December 2010. Logan’s growing up so fast!

Know what the difference is between the three boxes of tissues above? Before this week, I’d have probably shrugged and said “Not much”. My eyes were opened to a certain type of consumerism; someone smarter than me probably has a name for it, but for the lack of a better term I’ll call it “Mindless Re-Purchasing”. If you’re anything like me, once you start buying a certain brand and package of product, you’ll pretty much keep it up forever, without stopping to think if there’s something better or less expensive. Continue reading A Tale of Three Boxes of Tissues: Smart Consumerism

“He is no fool who gives what he cannot keep to gain what he cannot lose.”

– Jim Elliot (1927 – 1956)

I have my personal email configured in a very particular way; I have set it up so that anything@ sent to jasondunn.com will come to me (unless it’s been previously blocked). Why do I do this? The key problem with the way email works today is that once you give someone your email address, you lose control over it – they can sell it, share it, spam you with it, etc. Worse, unlike the telephone system where the caller is identified with a number that can be blocked (with the exception of hidden caller ID of course), there’s little you can do to protect yourself from incoming spam…if you block one sender, it will just come at you from a different one. The sender on the email is rarely the person or company actually generating the email.

By using a unique email address for every newsletter I sign up for, every company I buy from, and every account I register online, I have a system for figuring out who is spamming me, who is selling my email address, and I can turn off an alias if need be. There are some negatives to this approach mind you: it doesn’t keep me completely spam free, because eventually my real email address gets out there in the wild – likely from compromised email accounts or the malware-laden PCs of people that I correspond with – but it does afford me some granular control over how companies correspond with me.

I’ve turned off more than a few aliases over the years and that kills 100% of the spam that was coming in via that alias. This method does leave me vulnerable to dictionary-based email domain attacks, or domain reply-to hijackings, but both are exceedingly rare (say, three times in the past five years). People using Gmail can do something similar to my method, though it’s not quite the same because it still exposes your real email address.

Continue reading Email Spam, Database Hacking, and Customer Trust: A Tale of Battdepot and Rupaz

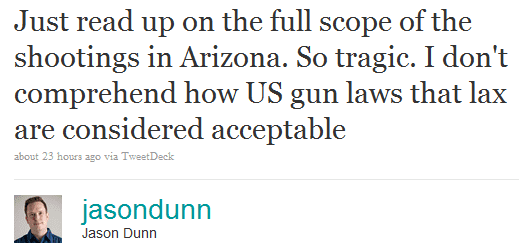

Below is a post I made to a private Facebook discussion that occurred in response to my Tweet above. I truly know very little about gun laws in the USA, or even much about them in Canada, but every time a violent person kills others with a handgun, the question of where did he get that handgun from comes up. It’s always a valid question, but it seems no matter how many people get killed by handguns in the USA, nothing changes.

*****************

OK, so I spent 10 minutes trying to re-find an article that I read yesterday and couldn’t…but in this article, it stated that the gunman went into Sportsman’s Warehouse that day and purchased a Glock and ammo, and I believe a 30 round magazine. Assuming that’s accurate, right there I have a few problems: being able to purchase a handgun immediately = disaster.

Handguns are either for killing someone else (or a lot of other people), or defending yourself from being killed. The decision to purchase a gun to commit violence shouldn’t be a fast, rash one. Giving someone permission to carry something on their person that can be easily concealed (regardless of what the law says about concealed weapons) should be a measured, controlled process, with only the most vetted of people being allowed to purchase one.

It should be a process that takes days or weeks, not minutes. It seems like the system failed on a bunch of fronts here based on what Vinny wrote – that if various people in law enforcement had done their jobs, he’d never have been able to purchase a gun because he would have failed his background check. Putting that aside though, the basic premise that you can go into a store and leave a few minutes later with a handgun and ammo is insane to me. Humans are emotional, rash creatures who make stupid decisions and making it quick and easy for someone to buy a gun is a massive mistake.

Why shouldn’t handguns simply be banned? Or why aren’t biometric measures required for handguns? The technology to prevent unauthorized firing of a handgun have been there for years, but the gun makers aren’t using them because it would drive down their profits. Can you imagine all the accidental firearm deaths of children if handguns were only able to be fired by the owner of the gun? It would also prevent things like that 17 year old kid last week who took his dad’s gun (who is a cop) and killed the principal and assistant principal.

I get that crazy, violent people will be crazy and violent no matter what. But why should it be so EASY for them to get their hands on something so finely tuned for dealing death? If he had purchased a shotgun or rifle from a hunting store, at the very least it’s a weapon that you can usually see someone coming at you with, and they typically have limited magazine sizes. I read that the 30-round extended magazine on the Glocks were outlawed in Arizona a few years ago, but then that law was overturned. Because, yeah, 10 bullets in a handgun is just NOT enough, you NEED to have 30 bullets in there. Am I the only one that thinks that’s completely bonkers?

And, not surprisingly, I heard today that handgun sales in Arizona are up 60%…and one retailer reported that his sales of Glocks doubled. So in a sadly typical response to gun violence, more guns are being put on the street, which can only lead to more violence.

I think very highly of the USA in many ways, but when it comes to your passion as a country for guns, I just don’t get it.

I’m in Las Vegas at CES, and I rented a WiMax modem from a company called Cheetah Wireless. Last year it was a decent solution – not as fast as I was hoping for, but pretty good. This year, it’s a disaster. Check out this pathetic bandwidth:

That’s so slow it feels like I’m using a 56K modem. It’s ugly. Cheetah Wireless is saying it might be a defective modem, but it feels like the real problem is that the WiMax signal is pathetically weak from my hotel room. It’s really hard to do much of anything with Internet this slow… 🙁

UPDATE: I wanted to add that although I was completely disappointed with the performance of my WiMax modem, Cheetah Wireless did everything they could to help. They offered to swap out the modem for me, but we were never able to connect. I used it at the airport for a bit, and the speeds were just as bad there, before I realized that the package to mail the modem back was inside my checked back. So I took the WiMax modem home with me to Canada, then mailed it back to Las Vegas – and the guy at Cheetah Wireless that I was dealing with was very understanding when I explained my error. I probably won’t go this WiMax route again – I’m going to pick up one of these…

I haven’t published anything lately about Concrete Equities or Wealthstreet, but things are continuing to evolve with those companies and the people who ran them. Late last year, a notice of hearing (or possibly two?) was held for Dave Jones (A.K.A. Colin David Jones), Rachael Poffenroth, Varun “Vinny” Aurora, David (Dave) Humeniuk, and Vincenzo De Palma. When we were clients of Wealthstreet, Ms. Poffenroth was the president of the company.

To any lawyer reading this: no statement made in this post can be considered libel; I am simply re-publishing publicly available information. I make no allegations myself, and all data provided is from public sources.

The two PDF documents below have the details, but allow me to quote two sections from the second PDF:

Allegations: Summary of Breaches (Page 3)

“1. Staff of the Commission (Staff) allege that Varun Vinny Aurora (Aurora), David Humeniuk (Humeniuk), David Jones (Jones) and Vincenzo De Palma (De Palma) breached the Act by acting as dealers without being registered in accordance with Alberta securities laws, and without an applicable exemption to the registration requirement, or by authorizing, permitting or acquiescing in such conduct by one or more corporate entities of which they were a director or officer.

The Impact of the Respondents’ Actions (Page 10)

“76. The Offending Partnerships and CE Fund collectively raised approximately $110,000,000, with $96,735,000 raised using the impugned Offering Memoranda referred to above. In total the Concrete Group raised over $118,000,000 through the issuance of securities to 3,723 investors.

77. On May 26, 2009 Partnerships 1 through 5 sought and obtained protection from their creditors through the filing of a Notice of Intention to Make a Proposal under section 50.4(1) of the Bankruptcy and Insolvency Act, R.S.C. 1985, c. B-3 as amended. On June 9, 2009 Ernst & Young Inc. was appointed as Interim Receiver of Partnerships 1-5.

78. On July 29, 2009 Concrete, the Offending Partnerships and each of their general partners were made subject to a Receivership Order (the Receivership Order). Ernst & Young Inc. was appointed Receiver for each entity.

79. Prior to the Receivership Order, the shareholders of the Concrete Group received distributions of slightly under $5,000,000. This represents a payment of only roughly 4% of their investment principal.

80. In contrast, prior to the Receivership Order, Concrete was paid over $15,000,000 in commissions as a result of the various Concrete Agreements. However, under the terms of those Concrete Agreements, Concrete was only entitled to commission payments of $10,107,750. Concrete was overpaid approximately $4.9 million.

81. In addition to the commission payments to Concrete, Aurora, De Palma, Humeniuk and Jones were also collectively paid over $8.0 million as directors of the various Concrete Group entities.

82. In its Third Report of the Receiver, dated December 2, 2009, Ernst & Young Inc, as Receiver, concluded that “based on the information presented in this report it is clear that the directors of Concrete mismanaged the affairs on Concrete in material respects.”

83. It is uncertain what recovery, if any, will be made by the 3,723 investors in the Concrete Group of their collective $118,000,000 investment, and significant further recovery of their investments is questionable.”

The two PDFs are below and can be downloaded, printed, or shared. Continue reading Alberta Securities Commission Notice of Hearing for Dave Jones, Rachael Poffenroth, Varun “Vinny” Aurora, David Humeniuk, and Vincenzo De Palma