Earlier this year, there were a couple of discussion threads started in the Canadian Business forums about Concrete Equities. The threads were full of useful information, and I posted in them several times. Curiously, right around the time that Vincenzo De Palma had his lawyers threaten to sue me for libel, the threads in the Canadian Business Forums were deleted. I don’t know why they were deleted – in fact a post I made there asking what happened was deleted – but it’s not hard to see the reasons why. Someone contacted me earlier this week about this topic; they’ve created a blog with all of the posts originally made to those Canadian Business Forum discussion threads about Concrete Equities. It makes for some interesting reading!

Tag: Wealthstreet

Are You a Promissory Note Holder With Wealthstreet?

As I mentioned in this previous blog post, for one year I was a promissory note holder with Wealthstreet here in Calgary. We loaned Wealthstreet the money, and got it back with 10% interest on top, and that was the end of it. They asked us if we wanted to re-invest it, and we declined. Others chose to re-invest, or invested for the first time within the past year, and now with Wealthstreet shutting their doors the holders of those promissory notes are wondering what they can do to get their money back. The building that Wealthstreet formerly occupied was purchased by a numbered company owned by Dave Jones, meaning it’s an asset with real value. If you are a holder of a promissory note from Wealthstreet and would like to get organized to take action, please send an email to ***@***. This email address does not go to me – that email address forwards to someone who is a current promissory note holder who is interested in hearing from other promissory note holders who want to take collective action.

UPDATE: The above email address no longer works. The person to whom it went has informed me that she’s no longer seeking other promissory note holders; she’s got a group of them together and they’re taking collective action.

What Happened to Wealthstreet and Dave Jones?

Because this blog entry of mine comes up third in Google for the term Wealthstreet, I feel a certain responsibility to share some information with people who are searching for what happened to their investments.

For those that haven’t heard, Wealthstreet seems to be no more. Their phone numbers are disconnected, and while their Web site still loads, it hasn’t been updated in some time. The last time I spoke with anyone from Wealthstreet was back in May of this year (and it was a hushed conversation involving whispering), and I suspect that once the hosting bills go unpaid for a few more months, the Web site will go off-line. The good news here is that Wealthstreet was “only” a broker – so if you invested in AGCAPITA, First West Properties (formerly Averio), or the MOSAIC Fund, your investments aren’t impacted by Wealthstreet imploding. If only the same could be said for our Concrete Equities investments.

I was concerned about the Dragon Fund however – this was a fund created by Dave Jones, and while we didn’t have much money in it, I had pretty much given up hope of getting it back. This article had a few interesting comments that related to that fund. I’ll reproduce them here in case the source article gets deleted:

“I managed to talk to someone last week and it looks like Dave has laid off all of his staff and has closed his doors. In regards to investments I was told that if you have invested in anything other then the dragon fund your money is o.k. as Wealthstreet was only selling shares, not a partner in the investments. The dragon fund however is a different matter as this was Dave’s fund. Currently it is up in the air as to what will happen to this fund and the money that investors put into it. If Dave can sell it investors may get their money back or at least most of it, but if that fund goes down with the Wealthstreet then all the invested money could be lost.”

And this one:

“The above posting pretty much on point. Concrete is what is is…not good…not good at all. Investments such a Mosiac & AgCapital are still whole and seem to be run by quality fund managers. Wealthstreet was simply a ‘broker’ for these funds. Dragon Fund was simply marketed through WealthStreet who acted as a broker for this fund as well. It is entirely seperate from WealthStreet itself and is managed as a seperate entity by Dave Jones. The sole asset in Dragon Fund (bareland in Airdrie) is currently up for sale. If the land is sold the funds from the sale of the asset should be returned to investors.

The trustees on the fund are actively managing the situation and have significant control even though Dave Jones is the fund Adminstrator. The trustees are not in a postion to gain anything financially are definitely looking out for the best interest of the investors. Now if you are a ‘promissory’ note holder that is another investment I would be very concerned about! Good Luck!”

The problem of course is that I don’t know how to get in touch with these trustees of the Dragon Fund…a Google search has come up empty. Does anyone have any contact information for anyone related to the Dragon Fund? Continue reading What Happened to Wealthstreet and Dave Jones?

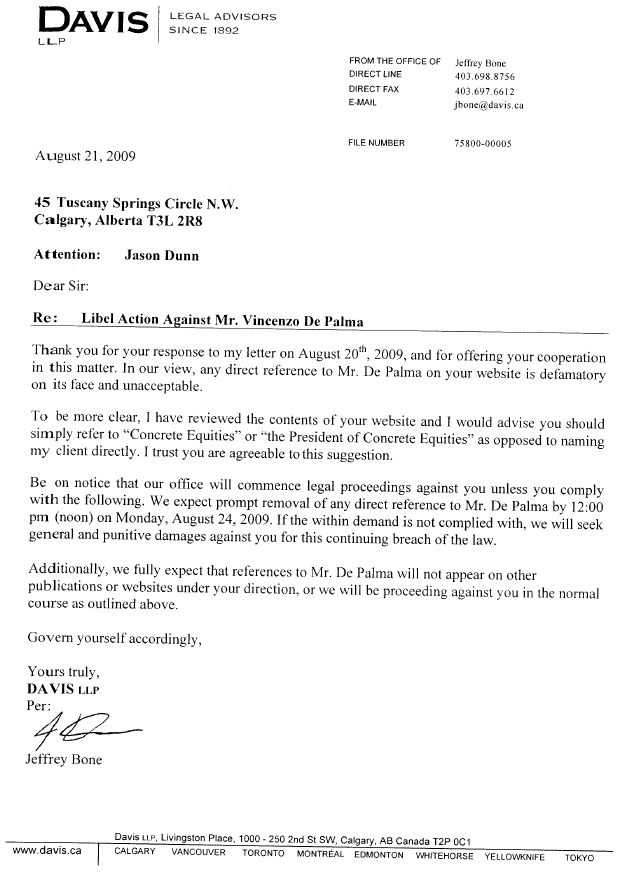

A Second Letter from Vincenzo De Palma’s Lawyer Claiming Libel

Above is a screen shot of the PDF file I was sent via email today by one Becky Mansour, Jeff Bone’s legal assistant. In order to “govern myself accordingly”, I’ve contacted the firm of BURNET, DUCKWORTH & PALMER LLP to advise me on this matter. I find it puzzling that Mr. De Palma’s lawyers think that simply writing the name of their client on this site is libellous. In my understanding of libel law, writing someone’s name online cannot be considered libel. At any rate, I have the weekend to consider my options and the advice of counsel.

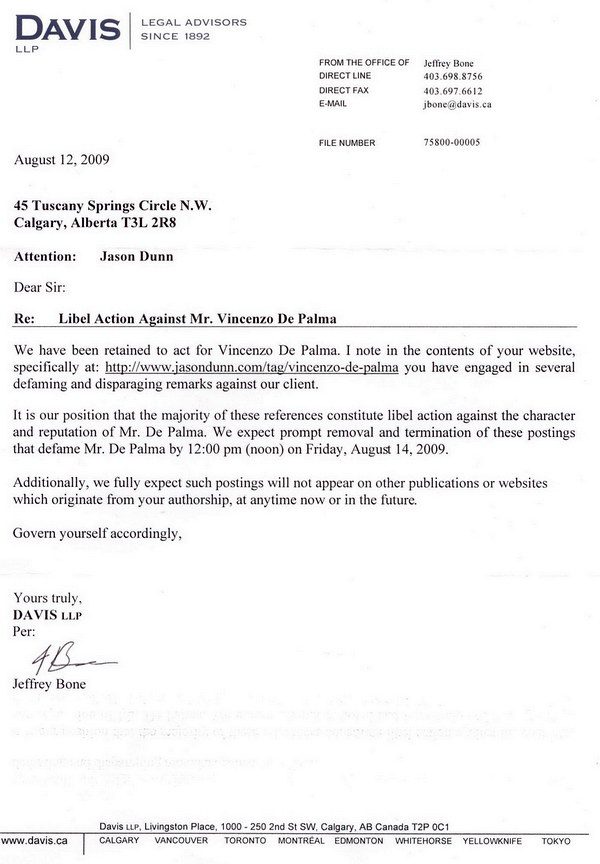

A Letter from Vincenzo De Palma’s Lawyer Claiming Libel

Fact: Vincenzo De Palma, President of Concrete Equities, has accused me of libel via his lawyer, Jeffrey Bone.

Fact: I received the following letter today, stating this:

Fact: I phoned Jefferey Bone less than an hour ago to inquire which of my “remarks” they consider to be “defaming” and “disparaging”, but I was unable to get in touch with him. I’m waiting to hear back from him and cannot proceed until I get clarification.

Fact: I’d much rather be editing videos of my son Logan than writing this blog post.

Fact: All information contained in this post is a fact.

UPDATE: I’ve had a short discussion with Jefferey Bone and he’s going to get specifics from his client and get back to me.

Concrete Equities Investor Meeting June 17th

I just got word via email that there’s a meeting for all Concrete Equities investors:

“There is a general meeting being held for “ALL” investors in Concrete Equities projects, including the Mexico Properties. It is very important that you attend this meeting being held:

Wednesday June 17, 2009 – 7PM

Southside Victory Village

6402 1A ST SW

We are now starting to receive emails from El Golfo investors asking “what is being done”, how does our investment stand”. To this end we have formed a Mexico steering committee and alligned ourselves with the Calgary Buildings Steering Committee.”

If you can be there, you should be there.

Calgary Herald: “Judge sides with Concrete Equities, makes appointment in dispute with disgruntled investors”

“A judge has sided with Concrete Equities in its application to appoint Ernst and Young as an interim receiver in a dispute with a group of disgruntled investors in five downtown buildings. By doing so, Court of Queen’s Bench Justice Barbara Romaine rejected the investors bid, at least temporarily, to have Concrete, a Calgary-based commercial real estate fund, replaced as general partner of the buildings that were placed under receivership earlier this spring. “I had hoped by this decision to enable the receiver to work on getting financial information to the limited partners as quickly as can be done,” said Romaine. The judge left the door open for the limited partners to argue on the issue of whether its choice of a new general partner should be named. That is scheduled for June 24.” – Calgary Herald, June 9th, 2009

Well that’s not good news – I know virtually nothing about the law in this area, but it’s rather curious to me that the judge wouldn’t allow us (the Limited Partners) to change the General Partner (Concrete Equities) to a new General Partner. I was under the impression that was our legal right, but apparently the judge didn’t think so. The judge said that she didn’t think we (the Limited Partners) had enough financial information about the buildings to make an informed decisions. That’s true, we don’t – but that’s solely because Concrete Equities is refusing to turn over the financial information to us. So why not order Concrete Equities to turn over the records and let us go our seperate ways? Concrete Equities doesn’t own these properties, we do. What a mess.

A Status Update From Concrete Equities

Although this isn’t relevant to most readers of this blog, I feel it’s important that I chronicle the events that are happening now with Concrete Equities – because it doesn’t look like anyone else has a blog on which they are doing so. My intention isn’t to turn this into a “Concrete Equities Blog”, but since I have a rather large chunk of money invested with these guys, I think you can understand why this issue is important for me to track.

This morning I received an update from the President of Concrete Equities Inc., via email. If you’re an investor with Concrete Equities, please take the time to read through this discussion thread (UPDATE: it has since been deleted, but Google’s cached version has some of the info) – you’ll learn a great deal about your investment and the status of is. That thread is also where they announce meetings of investors. As for this message from the President of Concrete Equities, it’s hard for me to separate fact from fiction. I think the financials will reveal the truth in time. This is a long message – the first section is about the Mexico investment, of which we have a unit in Santa Clara, and the remainder of the email is about the Calgary investments (we have the Castleridge investment).

Dear El Golfo (Santa Clara) Investor,

At this time, our firm would like to update you on current developments on this particular project. El Golfo de Santa Clara region remains viable for future tourist development. Being the first point of beachfront on the Sea of Cortez along the coastal highway in the state of Sonora it is developing into a great drive-to destination for Americans. When the project began, the coastal highway was under construction and the international airport was being conceptualized. Since that time the coastal highway is near completion and the international airport to service El Golfo de Santa Clara and the Puerto Puenasco (Rockypoint) area is well underway. Also please keep in mind that your investment is a solid, equity based land hold with no mortgage or debt position on your asset. Continue reading A Status Update From Concrete Equities

News Stories on Concrete Equities Protest

On Monday, June the 1st, over 200 investors who gave their money to Concrete Equities took to the street to protest what the company has done. I wasn’t able to be a part of it, but I applaud all those who were there fighting for our collective investments. Today, June 4th, Concrete Equities is being challenged in court by the lawyer representing the investors. We’ll see what happens – my understanding is that even though three of the five groups of limited partners have legally voted out Concrete Equities and put a new General Partner in their place, Concrete Equities is refusing to accept the results of the vote and turn over the required control.

Here’s a round-up of some of the media coverage the protest received, and some photos from people who were there.

“A commercial investment dispute spilled onto a downtown street yesterday as more than 200 investors protested in front of the head office of the company at the centre of the dispute.”

– Calgary Metro News Story

“The trouble started in March when Concrete Equites, as general partner, asked the limited partners to sell all of their real estate to a new company in exchange for company shares. The limited partners didn’t bite and they say they then ousted concrete as general partner in 3 of the 5 partnerships but Concrete did not cede control and instead filed papers in bankruptcy court asking that a receiver be appointed. Now investors can only watch as this drama plays out in court.”

– CTV News Story

“A group of disgruntled investors will head to court this week in a bid to regain control of their properties from Concrete Equities, a Calgary-based commercial real estate fund. More than 200 people protested outside the company’s offices Monday, demanding three years’ worth of financial statements related to the ownership of five buildings downtown that were placed under receivership earlier this spring….Mitrovic said the properties, which include the SNC Lavalin building downtown, were intentionally placed under bankruptcy protection in a desperate bid to prevent the installation of a new general partner in accordance with a series of votes that won the overwhelming approval of investors.”

– Calgary Herald Story

A few more pictures of the protest after the break. Continue reading News Stories on Concrete Equities Protest

Concrete Equities Admits To Breaching Alberta Securities Laws

Well check this out – looks like I should have been checking up on Concrete Equities late last year:

“CALGARY, Dec. 23 /CNW/ – The Alberta Securities Commission (ASC) has concluded a settlement with Concrete Equities Executive Club Inc. regarding allegations that it breached Alberta securities laws. As of June 2, 2008, Concrete Equities Executive Club promoted and sold Class B shares to 18 Alberta investors, raising $1,620,000. Concrete Equities Executive Club admitted it breached Alberta securities laws when it engaged in an illegal distribution by distributing its Class B shares to 13 of these investors without a prospectus and without being registered to trade in them. Concrete Equities Executive Club paid $80,000 to settle the allegations and $2,000 toward investigation costs. In addition, Concrete Equities Executive Club has offered to recind and refund all investors who purchased its Class B shares and has undertaken to refund the investments of the 13 unqualified Alberta investors.”

A word to all investors: always do research on the companies you invest with, and the people who run them. Especially the people who run them!

UPDATE: I found a CTV News story on this.