Credit cards. We’re awash in them as a society, and our exposure to them often starts in college (if not sooner). The day you get your first credit card, you join a system of credit and debt that can financially eat you alive if you’re not careful. I have nothing against the idea of credit cards – I use one constantly myself, paying it off every payday. And recently we used our card points to book a trip (more on that later). What I object to though is how credit card companies market their products: they send out those “you’re approved” letters, tempting people with credit problems.

Credit cards are a tool in your financial toolbox, but they’re a little like juggling a chainsaw. One or two are manageable, but if you try more than that, odds are you’re going to lose a hand (financially speaking).

Credit card companies are data-driven. They know that for every 1000 applications they send out, they’ll get a certain percentage of completions. Of the ones that get approved, most of them will turn into incredible profit generators for the company; most people don’t pay them off every cycle, and only accumulate more debt over time. But what if it became significantly more expensive for credit card companies to gain new customers this way?

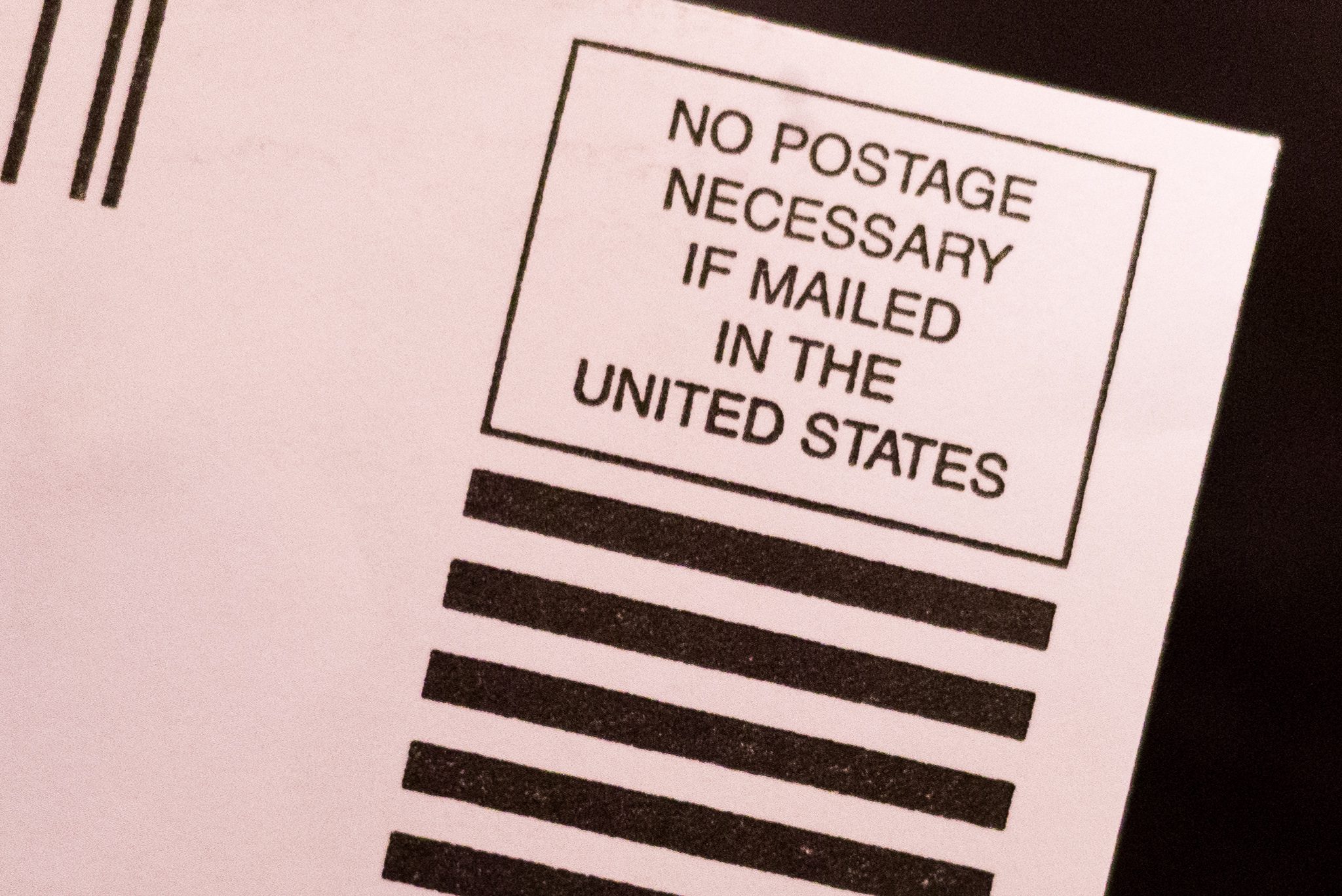

My solution is simple and shown in the image above: rip up the credit card application and send it back to them. They have to pay for postage, so this costs you nothing.

Credit cards are financial tools that should be available for financially mature adults who can use them responsibly. They should not be dangled in front of every like debt-candy.

If we all make it more expensive for credit cards companies to run unsolicited marketing campaigns like this, they might do it less often. Yes, I know it would take huge numbers of these going back to them to change their behaviour, but you have to start someplace. 🙂