I’ve had these documents for several years and had been meaning to put them up for public access – all text below is taken verbatim from the documents in question.

Alberta Securities Commission: Notice of Hearing (Oct 2010) [Download PDF]

To: Wealthstreet Inc, Colin Davis Jones (aka David Colin Jones, aka Dave Jones), Rachael Poffenroth

Allegations & Summary of Breaches:

- “Staff (Staff) of the Alberta Securities Commission (Commission) alleges that Wealthstreet Inc. (Wealthstreet), Colin David Jones also known as David Colin Jones (Jones) and Rachael Poffenroth (Poffenroth) (collectively, the Respondents) engaged in illegal trading and distributions of securities in Alberta to Alberta investors.”

- “Staff also alleges that Jones acted as an advisor in Alberta without being registered as an advisor, made prohibited and misleading or untrue representations to Alberta investors and engaged in unfair practices in transactions with Alberta investors.”

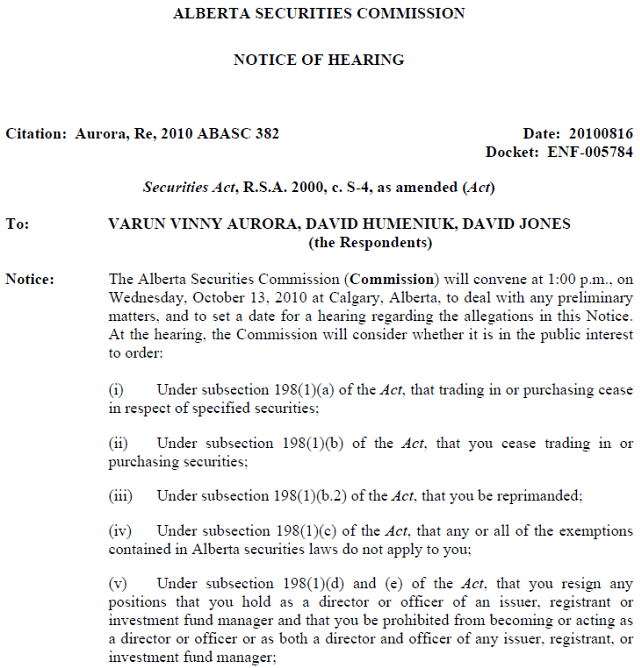

Alberta Securities Commission: Amended Notice of Hearing (Oct 2010) [Download PDF]

To: VARUN VINNY AURORA, DAVID HUMENIUK, DAVID JONES, VINCENZO DE PALMA

Allegations & Summary of Breaches:

- “Staff of the Commission (Staff) allege that Varun Vinny Aurora (Aurora), David Humeniuk (Humeniuk), David Jones (Jones) and Vincenzo De Palma (De Palma) breached the Act by acting as dealers without being registered in accordance with Alberta securities laws, and without an applicable exemption to the registration requirement, or by authorizing, permitting or acquiescing in such conduct by one or more corporate entities of which they were a director or officer.”

- “Staff allege that Aurora, Humeniuk and Jones breached the Act by making, or by authorizing, permitting or acquiescing in the making of, statements each knew, or ought reasonably to have known, were misleading or untrue in a material respect, or that did not state a fact that was required to be stated or that was necessary to make the statement not misleading, and that would reasonably have been expected to have a significant effect on the market price or value of the security in question.”

- “Staff allege that Aurora, Humeniuk, Jones and De Palma each breached the Act by trading in securities on his own account, or authorized, permitted or acquiesced in the trade of securities on one or more companies’ own account, in circumstances where such

trades were distributions, without having filed a prospectus or preliminary prospectus for which a receipt had been issued by the Executive Director of the Commission (the Executive Director), and for which no valid exemption applied.” - “Staff allege that Aurora, Humeniuk, Jones and De Palma each acted contrary to the public interest.”

Alberta Securities Commission: Notice of Decision (Dec 2011) [Download PDF]

To: Wealthstreet Inc, Colin Davis Jones (aka David Colin Jones, aka Dave Jones), Rachael Poffenroth

Recognition of Seriousness:

- “Jones, in our view, still does not recognize the seriousness of his misconduct. Communications to investors that are in evidence and his statements before us (on the few occasions that we saw or heard from him) demonstrate Jones’s persistence in contending that any issues with the Promissory Notes and the other securities sold through Wealthstreet were caused by global economic conditions and not his actions. He continues to accept no blame or responsibility for his illegal actions. When cross-examining investor witness KC, he implied that she was in a more balanced position with her current investments (through Wealthstreet) than she had been before meeting Jones. In fact, KC had gone from having retirement savings of over $200 000 and real estate equity of several hundred thousand dollars to apparently losing all of her savings and owing $540 000 on home equity lines of credit. In addition to not accepting responsibility for the financial harm he caused his clients, Jones seems unwilling or unable to appreciate the fact that his actions contravened Alberta securities laws and were contrary to the public interest.”

- “We believe that Poffenroth recognizes the seriousness of her misconduct and sincerely regrets both her involvement in Wealthstreet and the harm caused to Wealthstreet investors. She candidly admitted that she was not qualified to act as Wealthstreet’s president. She also testified during the Merits Hearing that she experienced “shock and hurt” at learning some of what Jones had done and how the investors had been affected. She appeared to accept the majority of the sanctions suggested by Staff as appropriate and expressed her intention not to be involved with public companies in the future. However, the evidence also indicates that Poffenroth had concerns about being under-qualified and being upset over some of Jones’s activities while still employed at Wealthstreet. Despite her concerns and reservations, Poffenroth continued for a time to act as Wealthstreet’s president and collect her generous remuneration. She later filed a claim with the Trustee for money owing to her from her wrongful dismissal claim. At no time did she report Jones or Wealthstreet to any regulators. We conclude that while some of her remorse and recognition of seriousness is genuine, some of that contrition stems from her desire to minimize the sanctions she might receive.”