“An Alberta Securities Commission (ASC) panel has found that David Jones, sole director and shareholder of Wealthstreet Inc., breached Alberta securities laws by acting as an advisor without being registered and engaging in an unfair practice by unreasonably pressuring at least one investor to purchase securities through Wealthstreet. The panel also ruled that Jones, Wealthstreet and former Wealthstreet president Rachael Poffenroth illegally traded in and distributed securities of Wealthstreet, and that all the conduct was contrary to the public interest.” – Alberta Securities Commission Web site

“A Calgary financial advisor well-known for his market reports on local radio and TV stations provided “disastrous” and “unconscionable” advice to some investing with him, the Alberta Securities Commission ruled Monday, adding David Jones used “scare tactics and falsehoods” with at least one client.” – The Calgary Herald

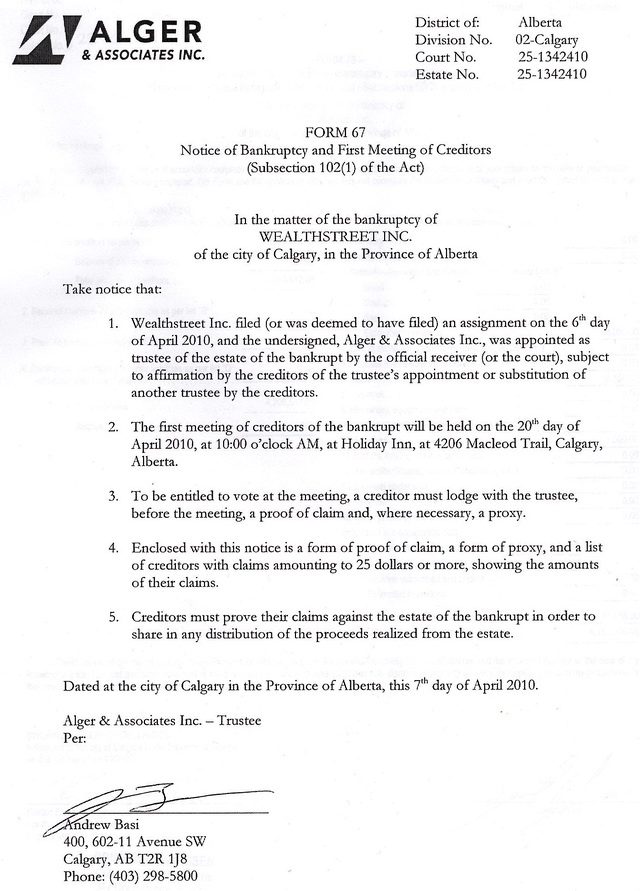

Not much to say is there? Dave Jones worked very hard to sell a lot of financial products to a lot of different people, and now he’s seeing the impact of his actions. Let’s not forget former Wealthstreet President Rachel Poffenroth – she was right there alongside Dave Jones. Now that the trial is done, sanctions will be determined at a later date.